Global Markets Rally as Investors Await Trump's Tariff Details

- by Chris White, RNG247

- about 9 months ago

- 112 views

Summary

1. Global stocks experience gains while gold reaches new heights, as investors look toward President Trump's impending tariff announcement.

2. The Reserve Bank of Australia maintains steady interest rates amidst global economic uncertainty, impacting the Australian dollar.

3. Concerns about the specifics of Trump's tariff plans contribute to heightened market volatility, influencing stock and currency performance.

Main Story

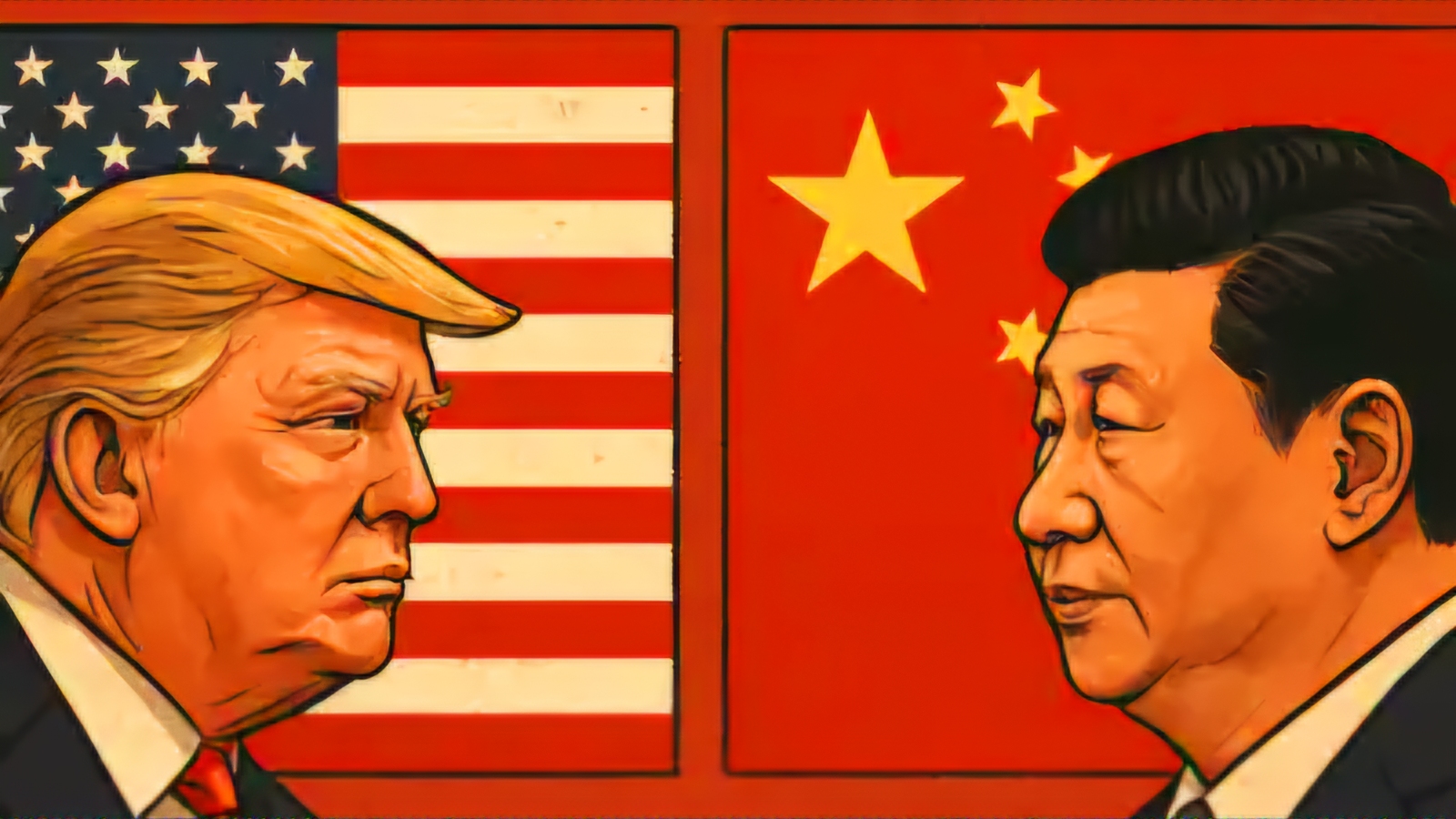

In a day characterized by upward movement in global markets, stocks surged following Wall Street’s positive overnight performance, while gold soared to an unprecedented peak as investors braced for significant developments on U.S. trade policy. The benchmark gold price hit a record $3,148.88 per ounce, continuing its ascent for four consecutive sessions, reflecting a growing preference for safe-haven assets as uncertainty over President Donald Trump's tariff plans loomed.

As financial markets await April 2—dubbed "Liberation Day" by Trump, who has promised to unveil an ambitious reciprocal tariff strategy—traditional haven currencies like the Japanese yen and Swiss franc remained resilient, drawing substantial demand amidst the economic turmoil.

Adding pressure to investor sentiment, the Australian dollar showed a recovery after the Reserve Bank of Australia (RBA) decided to hold interest rates steady at 4.1%, citing pronounced global uncertainties. The RBA's cautious approach highlights the delicate balance central banks must maintain amid shifting economic indicators and trade tensions.

Meanwhile, the release of the Office of the U.S. Trade Representative's comprehensive report on foreign trade barriers raised further questions without clarifying how it would influence Trump’s forthcoming tariff actions. Rumors, fueled by reports from the Washington Post, suggest that White House aides have crafted a proposal imposing tariffs of approximately 20% on a wide array of imports—yet details remain sparse.

European stocks experienced a recovery on this anticipation, rebounding from previous profit-taking sessions. The region's benchmark index rose by 0.9%, driven primarily by gains in pharmaceutical and technology sectors, which have been particularly sensitive to U.S. tariff policies.

Market analysts highlighted the uncertainty surrounding the imminent tariff announcement. "We still don’t know which countries will be affected and what the specific rates will be," stated Deutsche Bank strategist Jim Reid, encapsulating investor apprehension perfectly. With various volatility measures spiking recently, traders grappled with navigating a climate of unpredictability.

Despite the S&P 500 Index snapping a three-day losing streak with a 0.55% increase, futures showed signs of easing, indicating that much of the rebound may have stemmed from month-end transitory movements rather than a fundamental recovery in confidence.

Market participants are now weighing the ramifications that a potential U.S. recession could impose on equities, with some analysts predicting a further 10% drop if economic conditions deteriorate.

The rally in gold prices further reflects investors' shifting priorities, as growing concerns about the Trump administration's trade policies threaten to undermine the dollar's status as the world's reserve currency. “The fundamental backdrop remains strong for gold,” noted Kyle Rodda, a senior financial markets analyst at Capital.com.

The pressure on the dollar was palpable as Treasury yields fell, with benchmark 10-year notes down nearly 8 basis points to 4.169%. This shift led to a slight decline in the euro, which traded at $1.0805, while the yen appreciated, nudging the dollar lower to 149.40 and impacting the Swiss franc as well.

Market dynamics faced additional headwinds from geopolitical uncertainties, particularly regarding U.S.-Russia relations and ongoing tensions with Iran. Trump’s suggestions of secondary tariffs on Russian crude oil alongside threats towards Iran only added layers of complexity for investors.

As Bitcoin gained 2% to $84,218 and oil prices extended the Monday rally—Brent crude climbing by 0.5% to $75.13 a barrel—investors remained alert, bracing themselves for the potential fallout from forthcoming trade policy announcements. The day ended with the financial world holding its breath, eagerly anticipating developments that could reshape the global economic landscape.

0 Comment(s)